Ready Bytes Welcomes Pin Payments as an Esteemed Partner

A payment gateway to offer more payment options to your customers through Ready Bytes’ eCommerce Solutions.

What we liked the most about Pin Payments -

No Merchant Account Required

You can use Pin Payments as a credit card processor without troubling need of having a merchant account. It has been proved to be of immense help to the merchants all over in conducting hassle free money transfers.

Fast

Pin Payments is a time saving payment gateway as it accepts credit card without creating merchant account, so it is quite fast.

Flexible

The payment options are very flexible where you can use any cards like Visa, MasterCard, etc.

Popular

Pin Payments is growing as a very important eCommerce system in Australia and outer world since it has been launched due to its efficiency, expertise and easiness.

Easy Registration

You simply need to log in to their website and register yourself. It is easy and user friendly.

Good Support

The customer care service always seems to be good to resolve when any problem arises.

Simple Pricing

Pin Payments pricing is simple, and includes everything you need to take payments in websites, mobile apps, and in-person. Successful transactions are charged at 2.6% + 30c, with:

- No hidden interchange fees

- No minimum balance or security deposits required

- AUD, USD, NZD, SGD, EUR, GBP, CAD, HKD and JPY transactions included as standard

- Free automated fraud detection on every transaction

Easy Integration

Integration with Pin Payments have pretty easy settings - Just Set Publishable Key and shareable key. And start to capture the charge.

You can set different environment as per your needs-

a). Production " if you are using Payment Gateway Production / Live Account

b). Sandbox " if you are using Payment Gateway Sandbox / Test Account

Use this extension and get paid in multiple currencies, face-to-face or across the world!

Shyam Verma

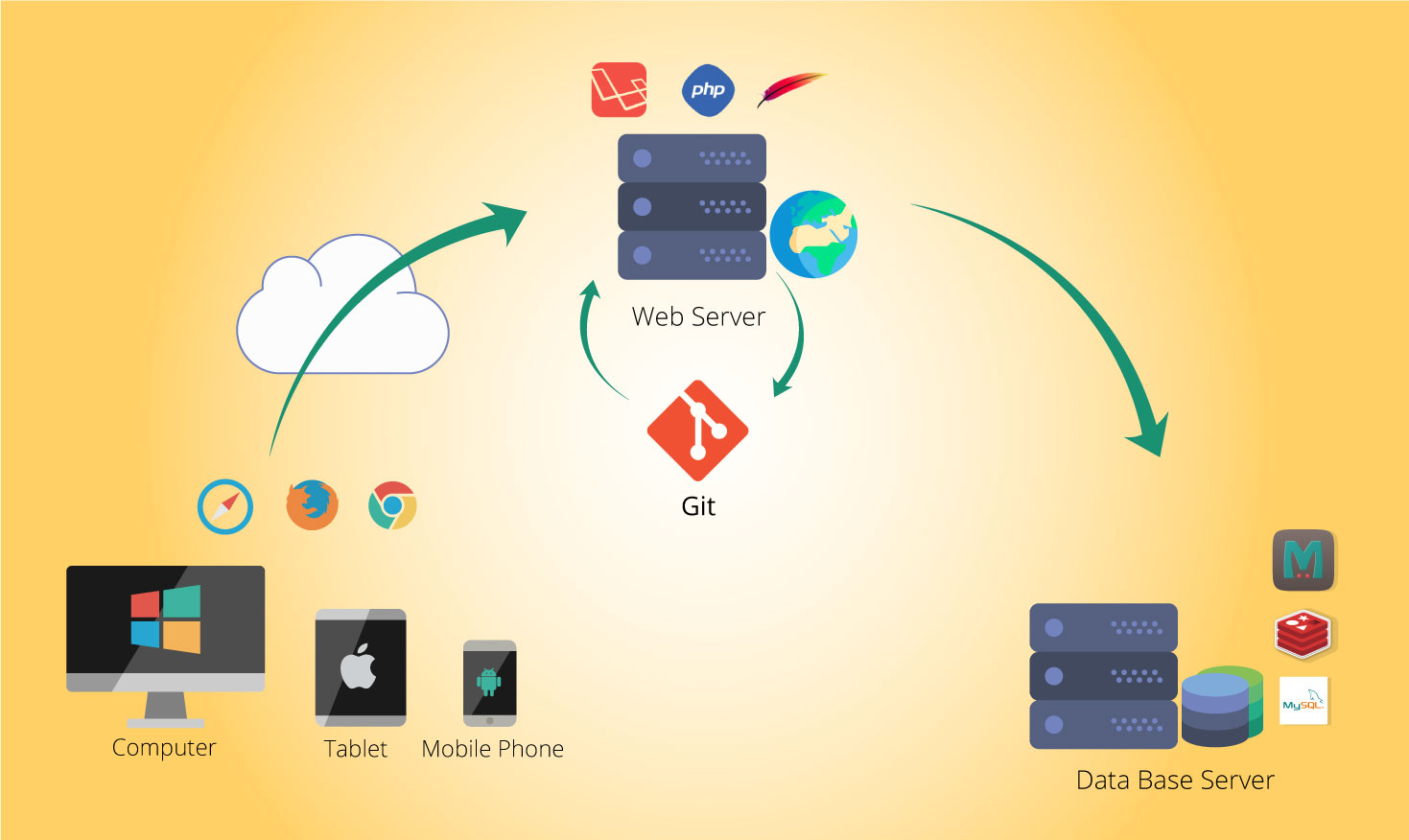

Full Stack Developer & Founder

Shyam Verma is a seasoned full stack developer and the founder of Ready Bytes Software Labs. With over 13 years of experience in software development, he specializes in building scalable web applications using modern technologies like React, Next.js, Node.js, and cloud platforms. His passion for technology extends beyond coding—he's committed to sharing knowledge through blog posts, mentoring junior developers, and contributing to open-source projects.