New Eu Vat on digital services will kill online ecommerce business !!

Handle EU-VAT taxation with Payplans

With 1/1/2015 new Eu Vat is ready to affect your business.

What does new Eu Vat Regulation implies ?

From 1st Jan 2015, new rule for Value Added Tax (VAT) is

applicable on supply of digital services by Business to Consumers in

EU. This means instead of paying the VAT in the country where your

company is registered, it will now need to be paid where the consumer

resides (If they are from the EU)

Whose business is going to get impacted with this ?

The legislation applies to digital products only

(telecommunications, broadcasting and e-services), such as Joomla

extension providers, downloaded applications, e-books, music, games,

online courses etc. If you have a physical store then taxes will apply

as before, so nothing to worry till 2016. And if you are selling both

then you have to maintain 2 different Tax rate for di.

Does all business who supply digital services get affected ?

If you supply any service or goods to any of the European

customer (B2C Model) irrelevant of the place you belong, then your

business have to comply with this new rules. A person living in Germany

pays a US company for to get access of any digital goods. Then US

company should charge the German customer with German Vat rate.

How can you deal with it ?

There are three options available :-

Register for VAT in each EU member state where your business

has sales. Potentially, this can mean registering with 28 tax

authorities.

Register with new system VAT Mini One Stop Shop (VAT MOSS).

Submit a single quarterly return and payment to HM Revenue and Customs

(HMRC) and reduce your administrative burden. Rest HMRC will send an

appropriate part of tax to relevant country.

- Don't Sell into EU, I know its isn't viable.

Hidden Challenges with this new Rule !

No Threshold Limit - If you sale to single

customer in a country even a product of 1$, you have to register for

vat system of that country ie there is no minimum threshold limit.

**Knowing the vat rates** - You have to remember Vat rate of 28

member states apart from your country. These vat rates varies from 15%

(Luxembourg) to 27% (Hungary). Not just this, you have to monitor

correct rate wrt time changes. Now think for **accounting expense** for

this.

**Keeping Records**- Need to keep track of records of**10 years**.

So it's advisable to to set up some proper accounting software, as

Payplans will not fully serve the purpose here since it is not an

accounting software.

**Record Location**- Keep**track of their location** using any of

the process like credit card information, billing address, Ip address

etc

How Payplans will help you to adopt these regulations?

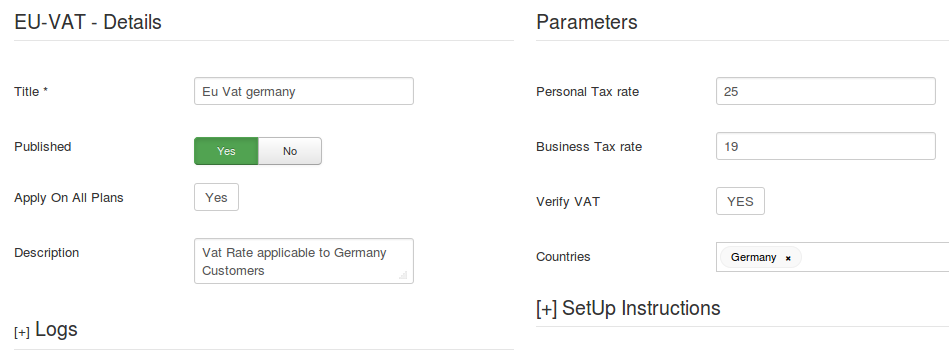

Payplans architecture is quite flexible which allows you to

create different eu-vat rules for different countries to properly

manage your taxable income.

During checkout process consumer needs to select his / her

country and respective tax rate will get applied.

Invoice With Eu Vat

Handle different tax rates for business and personal systems.

Eu-Vat App DetailsInvoice With Eu Vat

For collecting record location information like credit card

information, billing address, Ip address etc, you may use [user details](/blog?tag=payplans)

/ [subscription details](/blog?tag=payplans) apps of Payplans.

The new regulations were put to take more VAT from big online

players like Amazon, Apple, Google, Microsoft who used to sell most of

their content from Luxembourg which has the lowest VAT rate in the EU

but now it put burdens onto small business.

**Note of Disclaimer** - The above things are the best of

knowledge what we understand from new EU VAT regulations. So we

strongly suggest to consult all these with your

Accountant / CA / Taxable representative who look after your finance

system.

Anything to share?

If you have any additional tips or advice, share them in the

comments section below!

Shyam Verma

Full Stack Developer & Founder

Shyam Verma is a seasoned full stack developer and the founder of Ready Bytes Software Labs. With over 13 years of experience in software development, he specializes in building scalable web applications using modern technologies like React, Next.js, Node.js, and cloud platforms. His passion for technology extends beyond coding—he's committed to sharing knowledge through blog posts, mentoring junior developers, and contributing to open-source projects.