Different Types of Payment Gateways in E-Commerce

How to choose best payment gateway for your online business ?

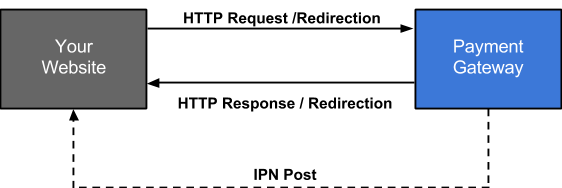

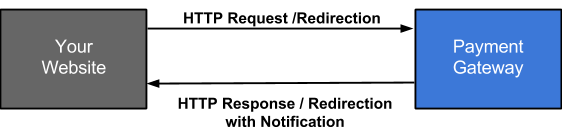

Type 1 - Hosted Payment Gateways

Process:

Hosted payment gateways will take a customer off from your site's checkout page. Once user clicks on pay now button at your website, user will be redirected to payment service provider (psp) page. Here user need to fill his/her payment details. Once the customer has paid, he/she will be redirected back to your website to finish the checkout process.

Another option is using an iframe. Payment service provider (PSP) creates a form (iframe) that the merchant store inserts to their website. By this merchants securely accept credit and debit card without capturing or storing card information on their website. Payment information is collected by using an inline frame (iframe). The form is hosted by the PSP, so when customers fill up the form, the PSP receives the data.

For recurring payments, profile is created for user with information of recurrence count , frequency, amount etc. Payment gateway will deduct recurring payments with the help of created profile and then sends payment notification to your website.

Refund and Cancellation of Payment need to be handled at Payment gateway's site.

Notification:

Notification URL can be set either at Payment gateway's website or in your Payment Gateway's script. Whenever any activity is executed for payment, notification will be send to that url and related action will take place at your website.

Example: PayPal Standard, 2Checkout, Payza, Setcom

Pros:

- Security - Cardholder details are securely captured by your payment service provider (PSP).

- Simple - Your PSP takes care of all the set-up, so just concentrate on running your business successfully.

- Customisable - Your logo can be can be added to the payment page for custom reassurance.

Cons:

- Customer Experience - Cannot control the end-to-end experience.

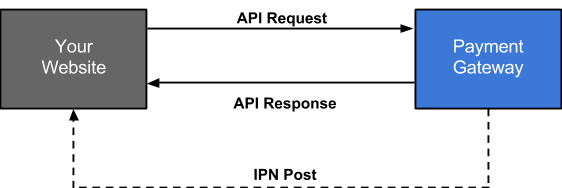

Type 2 - Pro / Self Hosted Payment Gateways

Process:

For these type of gateways, we need to ask the payment details from users, at our own website. After asking the details, we need to send the collected data to the Payment Gateway's url.

Some gateways need the data in specific format while some need any hash key or specific security/secret key.

In case of recurring the next payments is deducted by payment gateway itself and send notification for the same. Refund and cancellation process need to be initiated from Payment Gateway's website.

Notification:

Notification is send as silent post by the payment gateway. You need to mention your website's URL at Payment Gateways' website, where notification should be send. Each time when payment gets deducted a notification will be send and your script can work accordingly.

Example: Paypal website payment pro, Authorize.net ARB

Specialize case:

Authorize.net ARB deducts payment at 2 A.M. after the scheduled date.

Pros:

- Easy to Customize - Control your checkout from start to finish, and make customer experience as of your website.

- Customer Experience - Shoppers never leave your website, giving them more confidence when completing a purchase.

Cons:

- Security - Merchant has to take security measures to protect cardholder data.

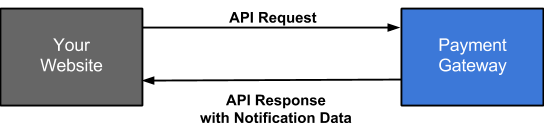

Type 3 - API / Non Hosted Payment Gateways - Payments at Merchant's site

Process:

Some merchants wants fully control on their checkout process and don't want to direct customers from their checkout page. If this is your case - then go with Non hosted gateway. It allows customers to enter their credit or debit card information directly on your checkout page and process payments using their API's or using some HTTPS queries.

This type of gateways mostly support recurring as well as fixed payments.

Notification:

Based on entered details system will internally create an payment calls to the payment gateway. These call could be of creating customer profile (for recurring only) at gateway for automatic future payments OR only for one-time payment. After creating call, payment gateway sends the notification in response to these calls. System needs to handle it and intimate the user for successful payment or the error (if there is any).

Some payment gateway also provide facility for Payment inquiry, Payment cancellation (cancels the future payment), Refund etc.

Example: Stripe, Authorize.net CIM

Pros:

- Flexibility - You have full control over what your payment page UI looks like.

- Customer Experience - Shoppers never leave your website, giving them more confidence when completing a purchase.

- Versatility - By using an API you can integrate your internet payment solution with any device connected to the internet (mobile phones, tablets, etc.).

Cons:

- Security - The responsibility for PCI DSS Compliance is all in your hands. It voids PCI Compliance.

- Service - Merchant may need to purchase SSL certification for better security.

Type 4 - Local bank integration

Process:

These payment gateways are also considered as hosted payment gateways which works in straightforward manner. User will be redirect to Payment Gateway's website and there he/she need to fill the payment details and contact details. After making payment user will be redirected back to your website and notification data is also sent with redirection.

These types of payment gateways didn't support recurring payment, refund and cancellation. Merchants need to do them manually.

Example: Bank Audi, Payseal

Pros:

- Simple - Good option for small business, who need one time payment options.

Cons:

- Advanced - It does not have some basic required features like refund and recurring payment.

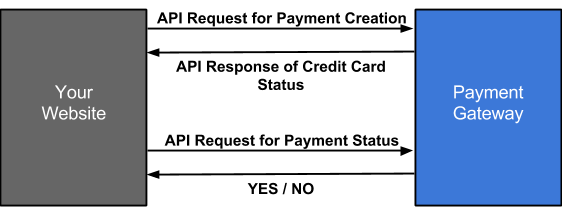

Type 5 - Direct Payment Gateway

Process:

Some of the payment processor doesn't support Instant payment notification. They create profile and deduct the required amount from the user's credit card on scheduled basis but does not inform the system (who requested for the amount). They just inform that whether credit card is approved or not. So in this case, system need to make an inquiry on regular interval to the payment processor that whether the required payment is received or not and accordingly provide further service.

These kind of processor generally ask information on your website and support both fixed and recurring payments

Example: Payflow Pro.

Pros:

- No redirection to payment gateway.

Cons:

- Generally does not provide the service ( for which you are paying) instantly.

- Require more technical efforts as multiple checking is required

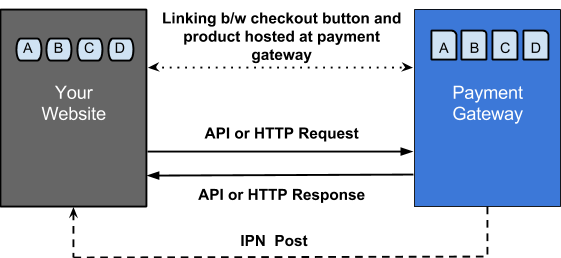

Type 6 - Platform Based Payment Gateway Solutions

Process:

These types of payment gateways provides platform to sell digital and physical goods directly from their server. Merchants need to create products or subscription in provided platform and users are redirected via check out button to this platform.

Customers are more likely to complete a purchase in their preferred language, and currency.

Example : Blue Snap, Gate2shop

Pros:

- Improve buyer conversion: Improve conversion by displaying the pricing in the local currency of each shopper.

- Guaranteed rate: Merchants don't need to worry about fluctuations in exchange rates, it will be handles by payment solutions.

Cons:

- Customizable: Cannot control user experience as it's a separate platform.

Choice is yours :)

We have cover the major one like workflow, security, look and feel, technical capability but still there are lots of other dependent things like price, transaction fees, supported countries, what product you want to sell etc.

Now, Choose best PSP for your business, after all it's your business which is unique.

Leave a comment to continue the discussion.

Shyam Verma

Full Stack Developer & Founder

Shyam Verma is a seasoned full stack developer and the founder of Ready Bytes Software Labs. With over 13 years of experience in software development, he specializes in building scalable web applications using modern technologies like React, Next.js, Node.js, and cloud platforms. His passion for technology extends beyond coding—he's committed to sharing knowledge through blog posts, mentoring junior developers, and contributing to open-source projects.